Page Contents

Related areas

Key contacts

On 31 July 2024, the High Court delivered a judgment in the matter of CBL Insurance Europe Designated Activity Company (CBL). The judgment dealt with a number of complex issues relating to the treatment of insurance contracts in a winding-up, including the admissibility of claims made after the winding-up order and the prioritisation of certain "insurance claims" under the Solvency II[1] framework.

The judgment is significant because it addresses a number of issues not previously addressed by the Irish courts. Although some aspects of the judgment relate specifically to winding up an authorised insurer, other aspects are relevant to winding up any insolvent company.

The Court addressed priority given by insurance legislation to policyholder claims for a return of premium; however, it did not directly address the priority given to other insurance claims under that legislation.

Timeline of key events

CBL was a non-life insurance undertaking, authorised in Ireland by the Central Bank of Ireland (CBI) that operated across the EU, specialising in construction-related credit and financial surety insurance, professional indemnity insurance, property insurance, and travel bonds. CBL was regulated under the European Union (Insurance and Reinsurance) Regulations 2015 (S.I. No. 485 of 2015) (the Solvency II Regulations).

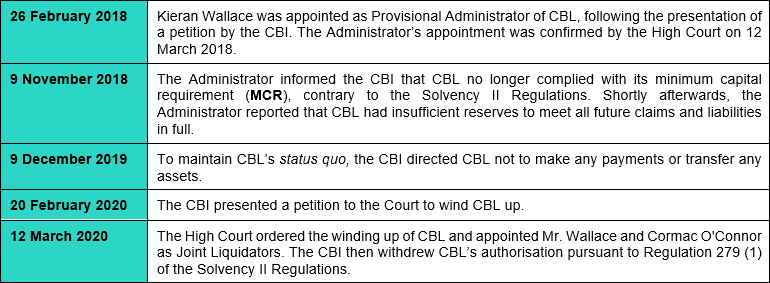

In February 2018, due to CBI concerns about CBL’s solvency, the CBI issued directions to CBL to cease writing new insurance contracts and renewing existing contracts. Below is a timeline of the key events that followed:

Application for directions

Section 631 of the Companies Act 2014 (the Companies Act) allows liquidators to apply to court to determine questions concerning the exercise of the liquidator’s powers. Using that facility, the Joint Liquidators applied to the High Court to determine a number of questions relating to the treatment of insurance claims in the liquidation of CBL. Below is a short synopsis of some of the key questions put to the Court for determination and the Court’s responses.[2]

1. Does a contract of insurance (which has not terminated automatically according to its own terms) terminate as a result of the commencement of the winding up of CBL and the withdrawal of CBL’s authorisation to carry out the business of an insurance undertaking?

Three possible dates for the termination of the insurance contracts were identified, namely:

The Court determined that CBL’s insurance contracts terminated[3] when the Court ordered that CBL be wound up on 12 March 2020. It based this determination on the provisions of the Solvency II Regulations and the related Solvency II Directive[4].

The Court also considered the legal basis for termination. It decided that the contracts terminated due to CBL's repudiatory breach of contract, which occurred when the Court ordered that CBL be wound up on 12 March 2020. The Court rejected the suggestion that termination was due to frustration resulting from the CBI withdrawing CBL’s authorisation to carry on insurance business. While CBL’s authorisation was also withdrawn on 12 March 2020, withdrawal occurred after the making of the winding-up order by which time the contracts had already terminated.

2. How should the Joint Liquidators treat claims made under policies of insurance which relate to:

Section 75 (1) of the Bankruptcy Act 1988 (the Bankruptcy Act), as applied by the Companies Act, addresses debts that a creditor can claim from the bankrupt estate of a debtor. These include “[d]ebts and liabilities, present or future, certain or contingent, by reason of any obligation incurred by the bankrupt or arranging debtor before the date of adjudication or order for protection.”

Following a lengthy analysis of the relevant provisions of the Bankruptcy Act and their interplay with the Companies Act, the Court determined that CBL incurred a contingent liability to pay the insured when it entered into an insurance contract. Therefore, the relevant “obligation” was “incurred” to policyholders when CBL entered into a contract of insurance. Accordingly, any claim made under a policy of insurance should be admitted to proof in the winding up, including a claim where the insured event occurs after the relevant date (12 March 2020).

The Court determined that in such circumstances the Joint Liquidators should, as best they can, make a “just estimate” of those claims as provided for in Section 620(1) of the Companies Act[5]. The Court accepted that this may result in underpayments or overpayments or policyholders receiving payment notwithstanding that a claim may never arise. The Court also noted that the value of claims arising from certain categories of policy falls to be determined on a basis set out in the Assurance Companies Act 1909 but that none of CBL’s policies fell into those categories.

3. Is an “unearned premium” an “insurance claim” as that term is defined in Solvency II Regulations?

The Court was asked to consider whether, having regard to the provisions of the Solvency II Regulations, a policyholder claim for a return of unearned premium (being a portion of the premium proportionate to the unexpired period of the policy) is an “insurance claim” as defined in the Solvency II Regulations. “Insurance claims” are afforded “absolute precedence” over all other claims that are not “insurance claims” with respect to assets representing the technical provisions of an insolvent insurer. This is subject only to precedence given to the expenses arising out of the winding-up where the other assets of the insurer are not adequate to meet those expenses.

The Court determined that a claim for return of unearned premiums is an “insurance claim” within the meaning of the Solvency II Regulations where the insurance contract concerned was terminated by virtue of the opening of winding up proceedings.It was not necessary that the contract be terminated before the opening of those proceedings. The Court put considerable emphasis on the policyholder protection policy behind the priority given to insurance claims are set out in Recital (127) of Solvency II.

Key takeaways

The judgment provides some helpful clarity for insurance providers, policyholders and practitioners alike, particularly regarding the impact on policyholders where a liquidator is appointed to an insolvent insurer.

The judgment also contained a helpful analysis of the decision of the EFTA Court in Gable[6], which concerned the interpretation of the term “insurance claim” considered in the third question, above. The High Court confirmed that, that while a decision of an EFTA Court is persuasive, it is not binding on the High Court, and it is open to a judge of the High Court to interpret a provision of EU legislation without being bound by a decision of a non-Union court. The Court went on to either distinguish the judgment of the EFTA Court in Gable or decline to follow it on the basis that it does not correctly decide or address the status of a claim for the return of unearned premium arising on the discharge or termination of an insurance contract on the opening of winding-up proceedings.

For more information on this topic, please contact James Grennan, Partner, Stephen Ahern, Senior Associate, or any member of ALG’s Insurance & Reinsurance and Restructuring & Insolvency teams.

[1] Directive 2009 138//EC, known as "Solvency II", sets out the framework for insurance and reinsurance regulation in the EU.

[2] For the purpose of this bulletin, we have paraphrased the questions put to the Court for determination. We have not addressed all aspects of the Court’s reasoning in summarising the Court’s determinations. Submissions on all questions were made by the Joint Liquidators themselves, as well as the Financial Services Compensation Scheme Limited (the Scheme Manager of the Financial Services Compensation Scheme in the United Kingdom. The Financial Services Compensation Scheme is the UK’s statutory fund of last resort where customers have claims against failed financial services firms).

[3] Described in the Solvency II Regulations as the contracts ceasing to produce effects.

[4] Note that this provision is particular to insurance and reinsurance undertakings; therefore, it does not determine the time at which contracts terminate for other companies in liquidation.

[5] The Court noted that insurance legislation prescribes the amounts payable to policyholders in respect of contingent claims under certain types of policy. However, CBL's policies were not of those types.

[6] Gable Insurance A.G. in Konkurs Case E-3/19 judgment delivered 10th March 2020