Defective concrete products levy reminder

On 15 December 2022, the Finance Act 2022 (the Act) was signed into law. In doing so it introduced the Defective Concrete Products Levy (DCPL). The Government introduced the DCPL to fund the redress scheme for homeowners affected by defective concrete products used in the building of homes. There are no prescribed timelines for how long the DCPL will remain in place.

Summary of key points

- The DCPL will be applicable to the first supply of certain concrete products supplied on or after 1 September 2023.

- The DCPL will be calculated at 5% of the open market value of the concrete product on the supply date.

- Under the Act:

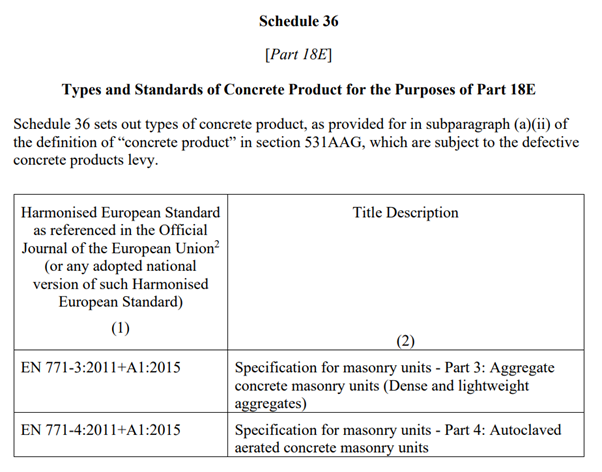

- A ‘concrete product is defined as a product that:

- contains concrete, and

- is of a type that is required to comply with the standard specified in column (1) of Schedule 36, and is of a type as set out in column (2) of that Schedule (see Appendix 1 of this Article for Schedule 36), or

- concrete that is ready to pour.

- ‘concrete’ is defined as material formed by mixing cement, coarse and fine aggregate and water, with or without the incorporation of admixtures, additions or fibres, which develops its properties by hydration.

- A ‘concrete product is defined as a product that:

- The DCPL will not apply on any second or subsequent supplies of a concrete product, but only in circumstances where a chargeable supply of the concrete product was already made in this jurisdiction.

- Liability for payment of the DCPL stays with the person that first supplies the concrete product within the state. The obligation to pay the DCPL will not travel with the concrete product.

- The DCPL will not apply to the supply of pre-cast concrete products.

- From 1 September 2023, a chargeable person making a first supply of a concrete product, must provide the following information to the person receiving the concrete product:

- the amount of the DCPL that has been applied to the supply of the concrete product

- the supply date of the concrete product subject to the DCPL, and

- the name of the chargeable person.

- It is advisable that contractors, employers, sub-contractors and others purchasing concrete products:

- seek evidence that the DCPL has been paid, or

- that the DCPL is not applicable if this is not the first supply, or

- if this is the first supply of the concrete product, that the supplier provides you with the above-mentioned information.

- The DCPL will operate on a self-assessment basis and the chargeable person will be liable to pay the DCPL to Revenue on a bi-annual basis. The first accounting period will commence on 1 September 2023 to 31 December 2023, thereafter it shall occur every six months commencing from 1 January 2024.

- Section 531AAQ (3) of the Act contains an express anti-avoidance measure. Where an arrangement is entered into for the supply of concrete products, where it could be reasonably considered that the main purpose of making the arrangement was to allow for the first supply of the concrete product to take place before 1 September 2023, so as to avoid the DCPL. Then the arrangement will be regarded as not having been in place and the DCPL will be applied.

- Section 531AAJ of the Act requires every chargeable person to register with Revenue, as a chargeable person prior to 1 September 2023. A chargeable person is a person who makes the first supply of a concrete product, e.g. the manufacturer, a retailer within the state, a contractor/sub-contractor who has purchased the concrete product from a party based outside of the state or private user. Where purchasing a concrete product which is the first supply of the product, evidence should be requested to show that the supplier is registered with Revenue for the purposes of payment of the DCPL.

How could the concrete levy impact a construction contract?

Whilst each construction contract may have been negotiated differently to capture a particular nuance in a project, we would typically see the following approaches being taken when it comes to a change in legislation:

- Contractor risk if the change in legislation was reasonably foreseeable at the date of the entering into of the construction contract or by the designated date. Employer risk if the change in legislation was not reasonably foreseeable at the date of entering of the construction contract or by the designated date.

- Contractor risk for any change in legislation that impacts on the works and that came into effect after the date of entering into of the contract or the designated date.

- Employer risk for any change in legislation that impacts on the works and that came into effect after the date of entering into of the contract or the designated date.

The drafting of the construction contract will determine whether or not a contractor will be compensated for the new levy or be responsible for the increase in the price of the concrete product as a result of the levy.

We expect that most discussions between employers and contractors will focus on construction contracts that include the ‘reasonably foreseeable’ wording. This wording is open to different intentions and each side will likely start with a different interpretation of when the levy was reasonably foreseeable. Agreeing a way forward will come down to the employer and contractor being able to agree on an approach or a third party determining the outcome that should be applied.

What does ‘first supply’ mean?

The Act defines ‘first supply’ as being a chargeable supply of a concrete product where a previous chargeable supply has not occurred.

‘Supply’ in relation to a concrete product being:

- the transfer of ownership of a concrete product by agreement or sale

- the assignment of a concrete product for use in a business other than by way of a transfer by agreement or sale as referred to above

- the private use, or the use in the course of a business, in the State of a concrete product.

Essentially, a person who either:

- makes the first supply of the concrete product within the state, or

- who purchases a concrete product outside of the state and imports the product into the state for its own use or future sale, shall be liable for the payment of the DCPL on or after 1 September 2023.

How is the DCPL calculated?

The open market value of the concrete product on the supply date, multiplied by 5% shall give you the amount of the DCPL that is payable.

If 10,000 units of concrete blocks are purchased for €10,000, then the amount of the DCPL shall be €500. Calculated as follows:

€10,000 x 5% = €500

Obligation to keep certain records

The Act contains an express obligation in relation to record keeping. The main obligation being to retain such records and relevant documents as are required to enable a full and true return to be made to Revenue for the purposes of payment of the DCPL.

A chargeable person is required to retain such records for a six year period commencing from the end of the accounting period in which the return was filed with Revenue.

The Act provides a non-exhaustive list of the documents that should be retained. This includes books, accounts, documents and any other data maintained manually or by any electronic, photographic or other process relating to the first supply of a concrete product. This may include:

- invoices, delivery and purchase records

- specific concrete product information which will enable the identification of the type of concrete product, and

- documentation recording the open market value of the concrete products.

Where a company engaged in the first supply of a concrete product is being wound up, dissolved or goes into liquidation, then the last directors of the company must retain the above records for a period of five years from the date upon which the company is wound up or dissolved.

Penalties for non-payment of the DCPL

If a chargeable person does not pay the DCPL due on or before the due date, the unpaid DCPL will attract interest of 0.0219% per day.

In addition to the above, a person engaged or that may be engaged in the first supply of a concrete product should also be aware of the following penalties:

- where the chargeable person fails to maintain adequate records and/or fails to issue documentation to the party that a first supply is made to, they shall be liable for a maximum penalty of €500

- where a chargeable person fails to pay the DCPL, they will be liable to pay the DCPL and a maximum penalty of €4,000

- where a chargeable person fails to submit a return within the bi-annual accounting period for any concrete product supplied within that accounting period, they may be liable to a maximum penalty of €4,000

- where a chargeable person fails to retain adequate records, as required under the Act, they shall be liable for a maximum penalty of €3,000.

Conclusion

In summary, both contractors and employers should:

- Check back over existing contracts to determine how changes in legislation are dealt with and where the risk lies in relation to the DCPL as and from 1 September 2023.

- Ensure that in any future contracts being entered into that both parties are clear on where the cost associated with the DCPL sits.

- Check, when purchasing concrete products, whether this is the first supply of the concrete product in the state and if so that the DCPL will be paid. Or seek evidence that the DCPL has already been paid.

ALG has market-leading lawyers in our Construction & Engineering departments. They are highly experienced across the full suite of construction contracts typically used in this jurisdiction (RIAI, PWC, NEC, JCT, FIDIC etc.). Our lawyers can advise on where the risk sits for the DCPL under existing contracts and advise on how to negotiate on the DCPL for future projects.

For further information in relation to the DCPL or any related matter, please contact Conor Owens, partner, Enda O’Keeffe, partner, Jamie Rattigan, partner, Jack Kennedy, senior associate or any member of the ALG Construction & Engineering team.

Date published: 24 August 2023

Appendix 1

Schedule 36 of the Finance Act