Employers must act now before ‘Single Person Corporate Vehicles’ drive into April 2021

With the unprecedented effect COVID-19 has had (and continues to have) many employers breathed a sigh of relief when the UK government announced that the Finance Bill 2020 due to be implemented on 6 April 2020 (outlining the revised IR35 regulations) would be postponed until 6 April 2021.

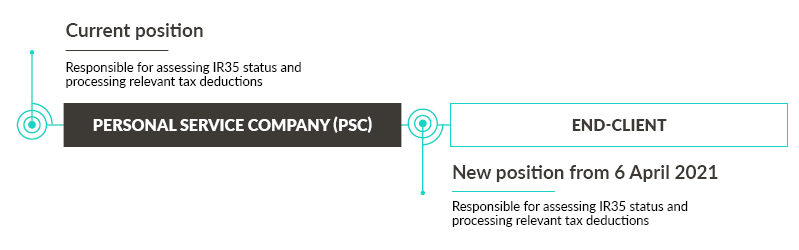

That said, with implementation on the horizon again, now is the time for "end-clients" (which will include many employers) to step into the driving seat and take affirmative action regarding their revised responsibilities under the revised IR35 rules. Those rules, bluntly, operate to transfer the responsibility for covert identification of legal and tax status from 'sub-contractors', consultants etc. to the end service user.

Below is a basic infographic summary of what these changes mean.

To find out more detail on what is changing please click here for our previous article.

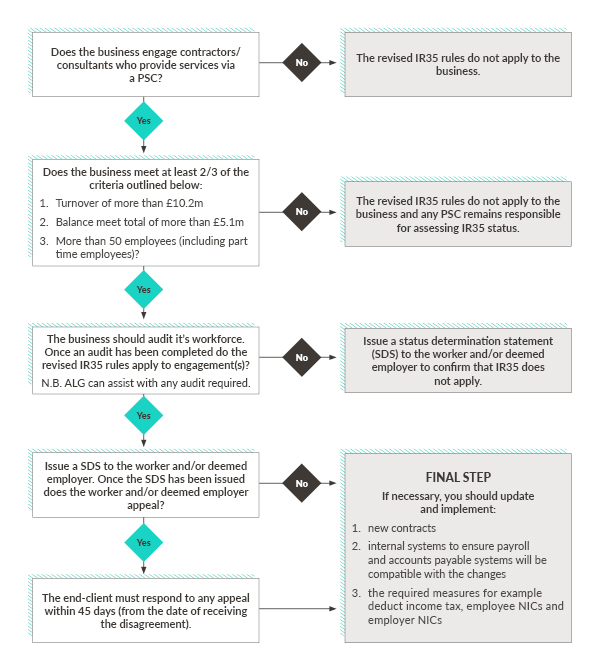

To assist, we have included a flow chart below outlining the various steps businesses at either end of the contractual spectrum should expect in order to prepare for IR35.

For more information please contact Gareth Walls, Partner, Emmie Ellison, Solicitor or a member of the A&L Goodbody Belfast Employment and Incentives team.

Date published: 17 September 2020