Page Contents

Key Contacts

Related Services

Background

In order to maintain the trust of investors and consumers, it is critical that policy makers and regulators address the risks associated with greenwashing. As a result, understanding the potential for greenwashing in the financial sector is a key priority for EU policy makers and regulators.

In May 2022, the European Commission (EC) requested each of the European Supervisory Authorities (ESAs) – the European Banking Authority (EBA), the European Securities and Markets Authority (ESMA), and the European Insurance and Occupational Pensions Authority (EIOPA) – to respond to certain questions on greenwashing and to deliver separate, but coordinated, progress and final reports.[1]

The ESAs’ progress reports were published in June 2023 and on 4 June 2024 each ESA delivered their final report setting out their respective approaches to regulating greenwashing (the Final Reports).

This article provides an overview of the common themes across the Final Reports before highlighting the key takeaways from each specific Final Report.

ESAs’ common understanding of greenwashing

As set out in their respective progress reports,[2] the ESAs confirm their common understanding of the concept of greenwashing as “a practice whereby sustainability-related statements, declarations, actions, or communications do not clearly and fairly reflect the underlying sustainability profile of an entity, a financial product, or financial services. This practice may be misleading to consumers, investors, or other market participants.”. In their Final Reports, each of the ESAs suggest that this common understanding should be used as a reference point by National Competent Authorities (NCAs) in assessing sustainability related claims. For example, ESMA invites NCAs to embed this understanding in supervisory guidance and provide specific illustrative examples.

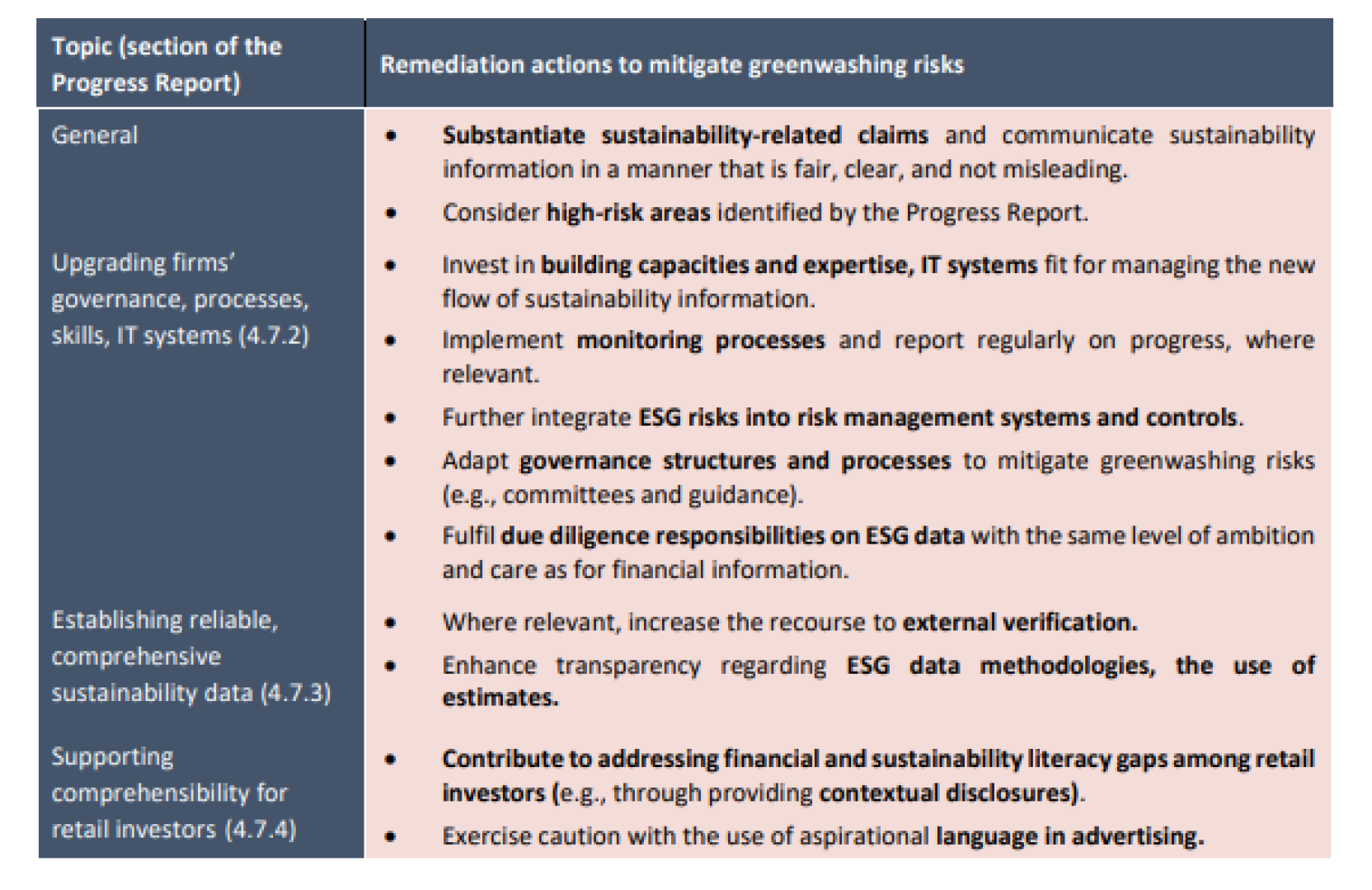

The ESAs stress that in scope entities have a responsibility to provide sustainability information that is fair, clear, and not misleading. There is also a focus across each of the three Final Reports on mitigating greenwashing risks, with practices that in scope entities can take as well as the role of supervision being considered.

On the presence of greenwashing to date, they note that NCAs have detected only a limited number of actual or potential occurrences of greenwashing. This could reflect multiple factors such as a low level of complaints; difficulties experiences by NCAs in accessing good quality data; or early successes by NCAs in preventing greenwashing in certain areas.

For NCAs generally, the ESAs each stress that more investment is needed on human resources and capability building to ensure that NCAs have the requisite expertise to investigate sustainability claims. Aligned with this, investment in supervisory tools, such as SupTech solutions, and the use of third-party data, are areas that the ESAs suggest that NCAs could consider to improve their scrutiny of sustainability claims.

Key takeaways from each Final Report

EBA[3]

In the banking sector, the EBA cited data which found that the total number of alleged greenwashing cases in the EU rose by 26.1% in 2023 compared to 2022.

To address this rise in greenwashing, the EBA is of the view that the most effective method is to focus on the “finalisation and implementation of the existing and planned initiatives.” Such frameworks include rules on consumer/investor protection that provide the legal basis for tackling misleading statements and sustainable finance related developments, including ESG disclosures and transition plans that should enhance transparency on sustainability practices. Efforts to address data, usability, consistency and international interoperability issues, the EBA’s Final Report found, should be prioritised in the short term.

To ensure that sustainability information is “fair, clear, and not misleading”, the Final Report emphasises that regulated institutions should observe key principles for sustainability claims to be “accurate, substantiated, up to date, fairly representative of the institution’s overall profile or the profile of the product, and presented in an understandable manner.” The EBA outlines specific guidance on practices for mitigating greenwashing for both the entity and the product/service level at sections 5.2 and 5.3 of the Final Report respectively.

Although the EBA emphasised that the existing frameworks already provide key foundations to address greenwashing, section 4 of the Final Report sets out areas of potential sources of greenwashing coupled with areas of potential EU regulatory mitigants, noting where there is uncertainty requiring regulatory improvements. The EBA flagged that further developments on aspects that are relatively less regulated, such as transition finance and green- and sustainability-linked loans, or where specific issues have been identified, such as the review of Sustainable Finance Disclosure Regulation (SFDR),[4] would “contribute to the robustness of the regulatory framework.”

ESMA[5]

ESMA emphasised that NCAs and ESMA have been implementing a risk-based approach to supervision, focusing their supervisory attention and resources on the most significant risks. Under the Union Strategic Supervisory Priority on ESG disclosures, ESMA prompts supervisory action with common objectives, including Common Supervisory Actions (CSAs), in the various sustainable investment value chain (SIVC) sectors where needed.[6] In this respect, the results of the CSA on sustainability-related disclosures and the integration of sustainability risks in the investment fund sector, which was launched by ESMA in July 2023, are expected to be published by the end of 2024.[7] For more details on this CSA and ESMA’s key supervisory findings, see our recent article on ESMA’s Final Report.

Helpfully, ESMA has set out in its Final Report several concrete actions to be considered by market participants, NCAs, ESMA and the EC, these can be found in Annex 1 of the Final Report. ESMA re-emphasise that market participants should consider the high risk areas identified by ESMA’s progress report as they relate to issuers, investment managers, benchmark administrators, and investment service providers (see figure 2, page 13, of the Final Report). ESMA’s Final Report contains a section that details the cross-sectoral considerations relating to the supervisory response to greenwashing as well as separate sections with insights for:

Regarding the current EU regulatory framework, ESMA notes that it “needs to gain in maturity to address certain usability and consistency issues.” It signalled that its views on potential improvements to the regulatory framework will be taken forward by a dedicated opinion which ESMA publish shortly. However, the Final Report indicates some areas where NCAs’ and ESMA’s mandates should be reinforced. In this regard, it recommended that:

Annex 2 of the Final Report maps the legislation relevant to the supervision of greenwashing, providing a high-level overview of the requirements.

EIOPA[9]

In its Final Report, EIOPA sets out nine key proposals to enhance the supervision of greenwashing and improve the sustainable finance framework. This is complemented by a “unified approach to supervision” in a separately published opinion establishing four key principles that NCAs should consider when probing an entity’s sustainability claims.[10] These principles provide that sustainability claims should be:

This unified approach is assisted by practical guidance on applying these principles, both for NCAs and insurance and pension providers. Section 3.2 of the Final Report contains real-world examples of what EIOPA considers good and bad practices in seven specific areas (including the entity and product level).

Beyond the supervisory challenges of greenwashing, EIOPA suggest potential improvements to existing regulation in three areas:

(1) clarifying what non-life insurance products with sustainability features are

(2) adopting a more consumer-centric approach in the Insurance Distribution Directive[11]

(3) further consideration of the sustainability related areas of its technical advice to the EC on the review of the IORP II Directive,[12] which was published in September 2023[13]

For further details on the key proposals set out by EIOPA, see our recent article on EIOPA’s Final Report.

Next steps

Although no ESA has recommended wide-ranging legislative change to the approach of regulating greenwashing, each ESA has identified specific areas where policymakers should consider further development. As noted above, ESMA has indicated that it will set out further views on this in a separate opinion.

In addition, all ESAs note that there would be a forthcoming Opinion of the Joint Committee of the ESAs on the assessment of SFDR, which was subsequently published on 18 June 2024.[14] Among other things, this opinion recommends that a new product classification system and sustainability indicator be introduced to help address the greenwashing problems arising from the misuse of the disclosures under Article 8 and Article 9 of the SFDR. In this opinion the ESAs also recommend that the EC should consider incorporating sustainability disclosures for structured products, as the actual assessment of their sustainability features is currently made at the sole discretion of their manufacturers and this, the opinion warns, “leaves room for greenwashing”.

Regulated entities in the financial services sector should:

With thanks to Garry O’Sullivan for his assistance in the preparation of this article.

For more information in relation to this topic, please contact Jill Shaw, ESG & Sustainability Lead or visit our ESG & Sustainability hub.

[1] The EC requested input on four separate questions relating to: (1) the definition of greenwashing and the forms it can take in the financial sector, (2) the risks greenwashing poses to investors and financial markets, (3) the implementation, supervision and enforcement of sustainable finance policies aimed at preventing greenwashing; and (4) the potential improvements to the regulatory framework.

[2] ESMA – ESMA30-1668416927-2498 Progress Report on Greenwashing (europa.eu); EBA – EBA progress report on greewnwashing.pdf (europa.eu); EIOPA – Advice to the European Commission on Greenwashing – (europa.eu).

[4] Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector.

[7] ESMA and NCAs to assess disclosures and sustainability risks in the investment fund sector (europa.eu).

[9] Advice to the European Commission on greenwashing risks and the supervision of sustainable finance policies (europa.eu).

[10] Microsoft Word - EIOPA-BoS-24-160- Opinion on sustainability claims and greenwashing (europa.eu).

[11] Directive (EU) 2016/97 of the European Parliament and of the Council of 20 January 2016 on insurance distribution (recast).

[12] Directive (EU) 2016/2341 of the European Parliament and of the Council of 14 December 2016 on the activities and supervision of institutions for occupational retirement provision (IORPs) (recast).