European Commission accepts further referrals of non-notifiable acquisitions from Member States under Article 22 EUMR

Article 22 of the EU Merger Regulation (EUMR) allows Member States to request the European Commission (Commission) to examine certain acquisitions, even where they do not meet EU merger control thresholds. Traditionally, the Commission has discouraged referrals of transactions which are non-reportable at a national level. However, this position was reversed in updated Guidance published by the Commission in March 2021, in which it indicated that it intended in certain circumstances to encourage and accept Article 22 referrals where the referring Member State(s) did not have the power to review the transactions concerned under national rules.

In two recent decisions, EEX/Nasdaq Power and Qualcomm/Autotalks, the Commission accepted that the acquisitions concerned – which did not meet EU merger control thresholds and were not notified in any Member States - met the criteria for referral under Article 22 EUMR. Following the Commission’s landmark decision in Ilumina/Grail, these decisions represent only the second and third cases in which the Commission, in application of its Guidance, has accepted jurisdiction under Article 22 over transactions which were non-notifiable at both EU and national levels.

Background

Under Article 22 EUMR, a Member State(s) can request the Commission to assess a transaction which does not meet the merger control thresholds applicable at EU level where it:

- affects trade between Member States

- threatens to significantly affect competition within the territory of the Member State(s) making the request

The Commission has not historically favoured referrals by Member States of transactions falling below the monetary thresholds contained in the EUMR where they were not reportable at national level. However, in its updated Guidance, the Commission, in a modification of this approach, indicated that it intended in certain circumstances to encourage and accept Article 22 referrals in cases where the referring Member State(s) did not have initial jurisdiction over the case.

It grounded this decision, in particular, on the increase in transactions involving businesses which generated little or no turnover at the time of the acquisition, but which had the potential to develop into significant competitors. It noted, for example, that in innovative sectors such as pharma or technology, a company might have a promising R&D pipeline but might escape a notification requirement as it had not yet begun exploiting the results of its innovation activities. The change in approach regarding Article 22 referrals was therefore an attempt, in part, to address a perceived enforcement gap in respect of “killer acquisitions”, i.e., deals involving the acquisition of nascent companies which had significant competitive potential, but which did not yet generate the revenues required to trigger merger notification requirements.

In determining whether to accept an Article 22 referral, the Commission noted in its updated Guidance that it would, in particular, have regard to the following criteria:

.jpg)

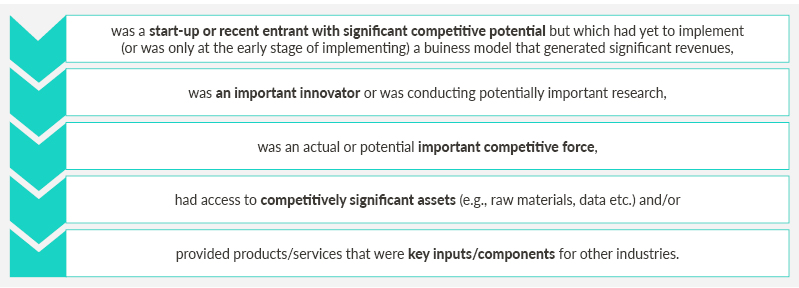

It described non-notifiable transactions in the referring Member State(s) involving one or more businesses whose turnover did not reflect their actual or future competitive potential as normally being appropriate for an Article 22 referral. It indicated that such cases would include, for example, those where the business:

Referrals in Qualcomm/Autotalks and EEX/Nasdaq Power

On 17 and 18 August 2023, the Commission, pursuant to its updated Guidance, accepted the second and third Article 22 referrals involving cases which were not notifiable at national (or EU) level.

In Qualcomm/Autotalks, fifteen Member States, including Ireland, submitted referral requests in respect of the proposed acquisition by Qualcomm of Autotalks, a manufacturer specialising in V2X semiconductors. The requests were accepted by the Commission, which noted that the deal would combine two of the main suppliers of V2X semiconductors in the EEA. It observed also that in view of the central role played by V2X technology in improving road safety and traffic management, the reduction of CO2 emissions and the deployment of autonomous vehicles, it was important to ensure that customers such as OEMs or infrastructure managers retained access to such technology on competitive prices and conditions.

In EEX/Nasdaq Power, the Commission accepted an Article 22 referral by Norway, Sweden, Denmark and Finland in relation to the purchase by EEX (an energy exchange) of Nasdaq's European power trading and clearing business. The Commission noted that the proposed transaction would combine the only two providers of services facilitating the on-exchange trading and subsequent clearing of Nordic power contracts. In asserting jurisdiction over the case under Article 22, it highlighted in particular the importance of ensuring a strong and competitive trading and clearing ecosystem to support the smooth functioning of energy markets, especially in view of the current energy crisis.

These cases follow on from the Commission’s first acceptance of such an Article 22 referral, which involved the proposed acquisition by Illumina of Grail, a developer of cancer detection tests relying on next generation sequencing systems. A challenge to the Commission’s grant of the referral request in Ilumina/Grail (upheld by the General Court) currently remains pending before the Court of Justice.

Consequences for businesses

Businesses should remain cognisant of the risk of transactions being called in by the Commission as a result of an Article 22 referral, even where they are non-notifiable at both EU and national levels, and of the associated suspension obligation for deals which have not yet closed. This risk will be particularly acute in cases involving nascent businesses in innovative sectors such as pharma and tech.

The Commission’s Guidance confirms that referral is also possible following the implementation of a transaction. However, the Guidance suggests that the Commission will generally not consider a referral appropriate where more than six months have passed since implementation (or where the implementation was not in the public domain, six months from when material facts about the concentration were made public in the EU).

As is foreseen in the Guidance, businesses may wish to approach the Commission, for an early indication as to whether it considers their concentration to constitute a good candidate for a referral. Businesses should bear in mind also the possibility of:

- third parties highlighting deals of potential interest under Article 22 to the Commission

- the Commission becoming aware of a transaction that it considers to meet the relevant criteria for a referral and inviting referral requests from the Member State(s) concerned

Ireland has already demonstrated its willingness (in the context of Qualcomm/Autotalks) to make an Article 22 referral request relating to a below-threshold deal. National powers to call in non-notifiable acquisitions will be further strengthened following the commencement of the Competition (Amendment) Act 2022, which allows below-threshold mergers or acquisitions to be called in by the Competition and Consumer Protection Commission where they may have an effect on competition in markets for goods or services in the State.

For further details regarding the Article 22 referral mechanism and how it might affect transactions being contemplated by your business, please contact Vincent Power, Alan McCarthy, Anna-Marie Curran, or your usual team EU, Competition & Procurement contact.

Date published: 6 September 2023