Holiday Pay: the Saga Continues

| Summary |

|---|

|

Almost every employer in Northern Ireland will be aware of the recent developments coming from the NI Court of Appeal relating to the calculation of holiday pay within the PSNI (NICA Decision). In summary, the three most significant directions given in the NICA Decision are set out below: 1. Workers in NI will be entitled to pursue claims for a shortfall in holiday pay from the date of commencement of the Working Time Regulations (Northern Ireland) 1998 (and subsequent 2016 Regulations) (WTR). 2. Workers are entitled to annual leave from whichever source (e.g. WTR, contract or otherwise); there is no requirement for certain types of leave to be taken in any particular order. 3. The appropriate reference period is fact sensitive to each case (and arguably, each worker). |

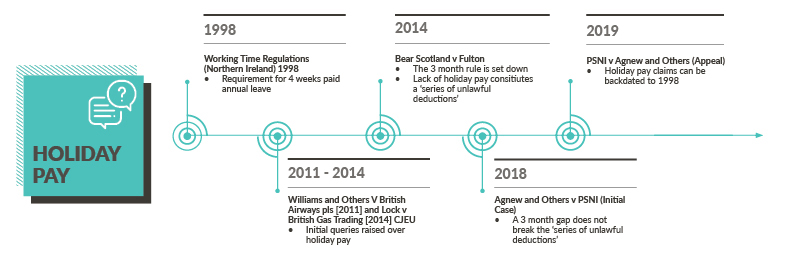

Despite the significant media attention arising from the NICA Decision, the calculation of holiday pay has been the subject of much debate and legal challenge over the past decade.

We have summarised some of the highlights (or, lowlights for employers, as the case may be) below.

Background

Article 7(1) of the Working Time Directive (2003/88/EC) (WTD) provides that every worker is entitled to at least four weeks of paid annual leave (WTD Leave). These rights are reflected in UK legislation at regulations 13 of WTR (and subsequently, regulation 15 of the WTR (NI) 2016).

Two cases from the Court of Justice for the European Union (CJEU) (Williams and Others v British Airways plc [2011] and Lock v British Gas Trading [2014]) raised initial questions over the Working Time Regulations 1998 (SI 1998/ 1833) (WTR) and the approach to the calculation of holiday pay.

The CJEU held in these cases that holiday pay for WTD Leave must be calculated in a way that corresponds with a worker’s ‘normal remuneration’, including (among others) all components intrinsically linked to the performance of the tasks they were required to carry out under their contract of employment.

If this resulted in a varying rate of pay, holiday pay had to correspond to a sufficiently representative reference period. Neither decision was definitive about how to calculate this reference period. This contradicted the common practice by employers throughout the UK, to pay holidays by reference to basic pay only.

Bear Scotland v Fulton [2014]

Following on from Williams and Lock, a case came before the Employment Appeal Tribunal in England known as Bear Scotland v Fulton [2014]. The judgment in this case enforced the view that employees who were regularly required to work overtime should get enhanced holiday pay to reflect the regular overtime worked.

The judge in Bear Scotland found that a gap of more than three months in a 'series of unlawful deductions' from holiday pay would break the 'series of deductions' (the Three Month Rule), meaning that this would limit the extent of historic liability in relation to back pay. For example, if an employee did not take annual leave for a period of three months or more, then a technical argument arose that the 'series of deductions' had been broken. Alternatively, if a lawful payment in respect of holiday was paid, it was argued that this would also break the series of deductions.

At the end of 2014, and on the foot of the Bear Scotland decision amidst mounting pressure from employers across the UK, the UK Government took action to reduce the potential historic liability. Statutory limitation regulations were brought into effect which introduced a backstop of 2 years historic exposure for any series of deductions arising from miscalculation of holiday pay.

Importantly, the limitation regulations did not extend to Northern Ireland and the decision makers in Northern Ireland at that time chose not to introduce similar 'backstop' regulations. However, the three month break in a 'series of deductions' as affirmed in Bear Scotland seemingly protected NI employers from unduly arduous financial exposure.

Alexander Agnew and Others v Chief Constable for the Police Service of Northern Ireland, 2018

In 2017, more than 3,000 PSNI officers and civilian staff commenced legal action over holiday pay calculations in the light of the Bear Scotland decision.

The Tribunal found in favour of the employees, holding the employer liable for not including overtime payments and allowances in their calculation of the Claimants’ holiday pay. In its decision, the Industrial Tribunal made a number of surprising comments which contradicted the settled approach outlined in previous caselaw, particularly in relation to the Three Month Rule.

In reaching its decision, the Tribunal made the following findings:

- A series of deductions will not automatically be broken by a three month gap as this can lead to arbitrary and unfair results. This directly contradicts the Three Month Rule set out in Bear Scotland, which had been relatively settled practice.

- An occasional correct payment in a series of payments may not breach the chain or series of deductions. Instead, identification of the factual link in the alleged series is what determines whether correct payments break the series.

- That each day of annual leave is a fraction of the whole entitlement; i.e. a day's leave consists of both a fraction of WTD leave, and a fraction of WTR leave (i.e. 8 bank / public holidays) and a fraction of any contractual leave, thereby creating a situation where every day of annual leave attracts an element of WTD Leave and related enhanced holiday pay, over and above basic salary.

- The reference period for each individual case varies. Where a worker works regular overtime, an appropriate reference period may be 12 weeks. However, for workers whose overtime peaks during a particular period, for example during July and August, an appropriate representative reference period is likely to be 12 months (calculated across 365 days not 260 'working' days).

- Regular voluntary overtime payments should be factored into the calculation of holiday pay.

Chief Constable for the Police Service of Northern Ireland and The Northern Ireland Policy Board v Alexander Agnew and Others [NICA], 2019 (the NICA Decision)

On 17 June 2019, the NI Court of Appeal upheld the ruling of the Industrial Tribunal on all grounds apart from the issue in relation to reference periods. On that point, the NI Court of Appeal deemed the Industrial Tribunal's finding in relation to calculation of the daily rate of overtime using 365 days (by reference to the 12 month reference period) was incorrect. It should instead be decided on a case by case basis in reference to the number of days actually worked in the previous year, not 365 days in a 12 month period.

The Court of Appeal ruling confirms Northern Ireland's divergence from Great Britain's position and NI employers faces significant exposure relating to backdated claims owing to the rejection of the Three Month Rule set down in Bear Scotland.

Implications for the Future

While the NICA Decision relates to the public sector, the findings will have an impact of all employers who have workers located in NI.

Workers (both in the private and public sector) who receive paid overtime or other ancillary payments such as shift premia, commission payments, bonus payments, present a high risk, with potential exposure dating back to 1998. We strongly encourage employers to seek specialist legal advice before attempting to take any remedial action, in order to assess extent and scope of historic, and ongoing, exposure.

We are working with a number of clients to address issues arising from the NICA Decision. Should you think the matters outlined in this article may affect your business, please contact a member of the ALG Employment team via the contact details below who will assist you with conducting an audit for potential exposure.

Assistance from external legal advisers for such an audit will allow employers to avail of the protection of legal privilege, which will be of particular importance, should workers from your workforce commence or threaten legal proceedings.

Breaking

As of today (9 July 2019), the PSNI have confirmed they have lodged an application seeking leave to Appeal the NICA decision to the UK Supreme Court. If this application is successful, then the UK Supreme Court will be instructed to opine on all aspects of the Tribunal Decision and the jurisprudence of the NI Court of Appeal. Watch this space.

For more information please contact a member of the Belfast Employment team.

Date published: 9 July 2019