IR35 – Employment in disguise will be taxing…

The UK Government's commitment to cracking down on concealed employment relationships is now beginning to take effect. The Government has recently published draft legislation outlining the new rules for off-payroll workers, confirming that from 6 April 2020 the rules for engaging individuals through personal service companies (PSCs) are changing.

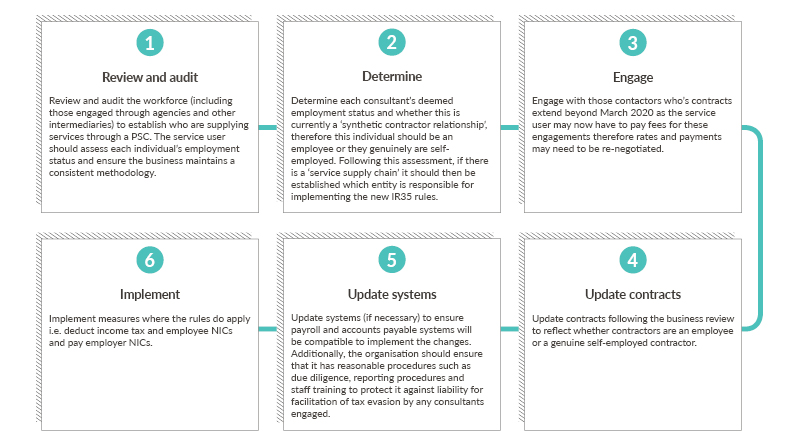

Nevertheless, with the 2020 deadline in mind, businesses which engage contractors (whether directly or through an agency) must act now to address the new compliance challenges created by the updated regime.

What is changing?

To increase compliance with the existing off-payroll working rules (often known as IR35) medium and large organisations ("the Service User") in all sectors of the economy will become responsible for assessing the employment status of individuals who provide services for them through their own limited company (the PSC or 'Single Person Corporate Vehicle').

The Government has confirmed that HMRC will focus on ensuring businesses comply with the reform for new engagements, rather than focusing on historic cases; therefore the reform is not intended to be retrospective, albeit HMRC has equally refused to rule out retrospective application.

The draft Finance Bill 2020 also introduces a Client-Led Status Disagreement process to allow the Service User's status determination to be challenged. Failure by the Service User to comply with the requirements of the new process will result in the Service User being treated as the fee-payer (and therefore liable to account to HMRC for income tax and NICs on any deemed employment income from the engagement). There is also a measure aimed at preventing the Service User from making blanket determinations as a bare statement will not be considered a status determination statement if the Service User fails to take reasonable care in coming to the conclusion mentioned in it.

Provision has also been made to enable the Government, via amendments to the PAYE Regulations (SI 2003/2682) to authorise the recovery of any unpaid tax from any "relevant person" (being a party to the arrangements in connection with which the deemed payment of employment income is treated as made).

How to prepare?

Westminster has committed to publish further guidance over the coming months to help businesses prepare for the rules coming into force. HMRC is also continuing to improve the CEST digital service and associated guidance – which is welcome indeed given its much criticised state currently.

For further information on how these changes may affect your business and to assist you in conducting an audit (which will attract the benefit of legal privilege), please do not hesitate to contact the Employment team at A&L Goodbody.

Date published: 12 August 2019