ALG’s annual review of Irish merger deals notified to the CCPC in 2019

Irish merger deals notified to the CCPC in 2019 drop by over half but rebound seems underway

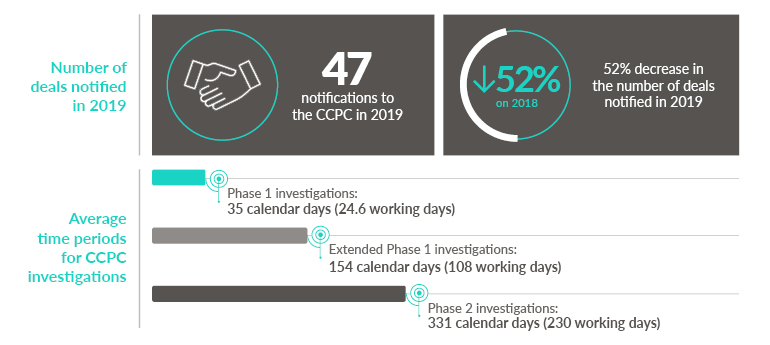

Figures from Ireland's Competition and Consumer Protection Commission (CCPC) in January show a 52% drop in notifiable merger deals in Ireland in 2019 over 2018.

The main reasons for the drop was a change in 2019 of the notification thresholds for business undertaking a merger and market uncertainty, including Brexit.

More in-depth analysis of 2019 and outlook for 2020 can be found in A&L Goodbody's (ALG) annual review of Irish merger control.

Our analysis reveals seven important points for Irish businesses contemplating M&A activity:

- 40% of all deals notified in 2019 were notified in the last quarter (more than in the entire first half of 2019 and twice that of Q4 2018) - this could well indicate that there is a rebound in merger activity and an easing of Brexit uncertainty.

- Technical and procedural issues are becoming more significant and the rules are being implemented much more vigorously.

- A halving of the notifiable deals in 2019 over 2018 does not mean that deals will be assessed quicker by the CCPC. The average length of non-extended investigations by the CCPC was 35 calendar days, similar to 2018.

- Irish business must follow the correct procedure to ensure notifications to the CCPC are made correctly. There are significant penalties if business do not to notify the CCPC prior to a merger taking place or wait for clearance to be given before implementing the deal.

- Business are missing the opportunity to provide comments to the CCPC on merger deals that are taking place. This is particularly important if they are potentially impacted by a merger. In 2019 the CCPC received comments in very few notifications.

- In certain circumstances, businesses should consider voluntary notifications to the CCPC even if a merger does not meet the notification thresholds. This precautionary action could avoid subsequent issues with the CCPC.

- While more complex deals lead to more prolonged assessment and investigation, they may also require additional commitments by the merging parties to ensure CCPC approval. This was evident in four deals in 2019.

Commenting on the analysis, Dr Vincent Power, Head of EU & Competition at ALG, said:

"The CCPC has made great progress in making merger notifications more efficient and we can expect that to continue this year with a new simplified procedure. This will allow the CCPC to devote more time to assessing and investigating notified deals. So Irish businesses can expect more scrutiny if the merger, acquisition or joint venture has competition issues or there is any procedural defect. The Irish system is maturing and becoming more complex so executives need to be careful not to be tripped up by the Irish-specific rules."

Outlook for 2020

- Probable increase in number of notifiable merger deals. The surge in deals in the last quarter of 2019 may be linked to greater clarity on Brexit which could extend into 2020.

- Increased scrutiny by the CCPC on procedural requirements – during 2019, the CCPC placed a greater focus on merging business following the correct notification procedures. We expect that to continue. So merging business should prepare notifications thoroughly.

- More efficiency planned by the CCPC – a simplified merger procedure due by the end of Q1 this year has the potential to be less burdensome for merging businesses but will take time to bed in.

For more information on this topic please contact any member of A&L Goodbody's EU, Competition & Procurement team.

Date published: 17 January 2020