The Climate Action Plan 2019: Electricity and Renewables

What is the Climate Action Plan?

What is the Climate Action Plan?

On 17 June 2019, the Irish Government published the '2019 Climate Action Plan' and an 'Annex of Actions' setting out a cross-sector suite of objectives and actions aimed at reducing Ireland's carbon emissions. The plan includes a number of new – and existing – measures that will have broad implications for the electricity sector.

Importantly for market participants, it incorporates many of the recommendations of the Joint Oireachtas Committee on Climate Action which were published earlier this year, in a report titled 'Climate change: a cross-party consensus for action', suggesting that climate policy and regulation should enjoy relative consistency going forward.

Sizing the opportunity

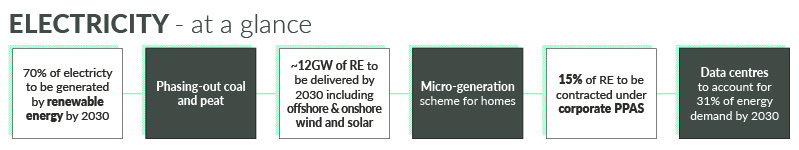

The Climate Action Plan includes an ambitious target to deliver 70% of Ireland's electricity from renewable energy by 2030. In doing so, the Government has identified clear winners (wind, solar and CHP) and losers (coal and peat). In order to meet the forecasted growth in energy demand, including from data centres and electric vehicles, the plan envisages an additional 12GW of renewable energy capacity coming online by 2030. The Republic of Ireland currently has over 3,000 MW of installed renewable energy so this target effectively represents increasing that capacity four-fold.

The path to achievement includes:

- Increasing carbon tax: Carbon pricing will remain a key tool for incentivising further increases in the build-out of renewable energy. Pursuant to the plan, carbon tax is expected to increase to at least EUR 80 per tonne by 2030.

- Phasing out fossil fuels: It spotlights a necessary shift in strategy for the Government semi-state power producers. Bord na Móna will transition away from peat by 2028 and ESB will be required to end coal-burning at the Moneypoint power station by 2025, though these time frames will remain subject to ongoing review.

- Deploying of renewable energy: It envisages that the new build will be compromised of:

- At least 3.5 GW of offshore renewable energy;

- Up to 1.5 MW of grid-scale solar energy; and

- Up to 8.2 GW of onshore wind capacity.

- Facilitating Micro-generation: The potential long-term impacts of and support for distributed generation will be noted by energy developers and investors. Building on an existing pilot program, a permanent ongoing support scheme which would enable individual homes to install their own generation and receive a price for selling excess electricity back to the grid will be put in place by 2021.

How do we get there?

The Climate Action Plan suggests that the next era of project development will kick-off in Ireland as soon as Q1/Q2 2020 once successful grid applicants (from ECP-1) know whether they have been successful in the first competitive renewable energy auction.

- Implementing the Renewable Energy Support Scheme (RESS): It offers a definitive path forward with respect to RESS. According to the plan the 'Detailed Design' is set to be finalised in Q3 2019 and the qualification process for the first RESS auctions will begin in Q4 2019. Notably, it is unclear whether the highly anticipated auction itself will occur within the calendar year but the Government's actions suggests that it is imminent. The plan promises more frequency in RESS auctions and a route to market for offshore in the second and subsequent auctions. See further A&L Goodbody's article on 'The Climate Action Plan and Offshore Wind'. The plan reiterates the Government's focus on increasing community participation as well as "community gain arrangements" – a 'Community Framework' will be published in Q4 2019 but little else is offered with respect to how this will work in practice.

- Scaling up Corporate PPAs: The Government anticipates that at least 15% of new developments will be contracted under Corporate PPAs by 2030. While a precise definition of 'Corporate PPA' is not included in the plan, it is assumed that this is a reference to unsupported projects that have bilateral contracts with large energy users. In any event, the Department of Communications, Climate Action and Environment (the Department) will publish a set of policy recommendations with respect to Corporate PPAs in Q4 2019, but it is unclear (at least for the moment) what tangible steps the Department and regulators will take to facilitate their adoption.

- Facilitating Grid Connection: It includes greater clarity on the timeline for the next round of grid applications under the Enduring Grid Connection Policy (ECP) – offers are expected to be processed in Q3 2020. The plan also states that the Commission for Regulation of Utilities (the CRU) will undertake a review of hybrid connection requirements which are required to facilitation an increase in RES-E penetration.

- Streamlining Regulations: It highlights a number of initiatives focused on streamlining regulations particularly with respect to planning. For example, the Department of Housing, Planning and Local Government is expected to publish the Strategic Environmental Consultation on Wind Energy Guidelines later this year with a view to finalising them in Q4 2019. The plan also acknowledges that a more holistic consenting regime and grid connection framework is needed to facilitate the development of offshore projects. This will include prioritising the passage of the Marine Planning and Development Management Bill and ensuring that the implementation of new offshore grid connection policy lines up with the RESS auction time frames. See further A&L Goodbody's article on 'The Climate Action Plan and Offshore Wind'.

- Continuing Focus on DS3: To facilitate a higher penetration of variable renewable electricity by 2030 (both SNSP and average), it also outlines various steps that are being taken by EirGrid and the CRU in this regard. See further A&L Goodbody's article on 'Battery Storage Opportunities for Ireland'.

- Increasing Interconnection: Following recent CRU publications on interconnectors, it underscores the Government's commitment to building further interconnection with the United Kingdom and France.

What to expect?

This Plan, together with the policy initiatives and regulatory development that are running in parallel, is likely to send positive investment signals to those seeking to participate in the next wave of development activity in the Irish market from 2020 onwards.

For more information contact Alan Roberts, Alison Fanagan, Jason Milne, John Dallas, Ross Moore or any member of the Environmental & Planning or Energy, Infrastrucutre & Natural Resources teams.