Whistleblowing in Ireland – the next batch of employers soon to be in scope!

Ireland’s whistleblowing regime has changed significantly as a result of the transposition of the EU Whistleblowing Directive on 1 January 2023 by means of the Protected Disclosures (Amendment) Act 2022 (the Act).

In this first part of a three-part series on whistleblowing in Ireland, we take a look at some of these changes and in particular the requirements relating to internal reporting channels and procedures which will apply to all employers with 50 or more employees from 17 December 2023.

Background

Since 1 January 2023, all employers in Ireland, regardless of their headcount, have been impacted by certain provisions of the Act. As all of the following qualify as a ‘worker’ under the Act, any of these can now make a protected disclosure to any employer:

- an employee

- contractor

- agency worker

- shareholder

- volunteer

- board member

- a job applicant

- a former employee

Furthermore, the Act reverses the burden of proof in penalisation claims so the onus is on the employer to prove that any alleged penalisation was not prompted by the making of a protected disclosure. There is also greater scope for employees to apply for injunctive relief to the Circuit Court to restrain acts that are alleged to constitute penalisation.

Internal Reporting Channels and Procedures

Significantly since 1 January 2023, the requirement to have internal reporting channels and procedures has only applied to:

- private sector employers with 250 or more employees

- public sector employers

- employers which fall within the scope of a wide range of EU directives in areas such as financial services and insurance

However, from 17 December 2023, all private sector employers with 50 or more employees must fulfil this requirement. This is a very significant change for employers with between 50 and 250 employees and will require action to be taken by these employers to ensure compliance with their statutory obligations.

Internal reporting channels and procedures may be:

- operated internally by a person or department designated for that purpose (e.g. the Head of Compliance), or

- provided externally by a third party

In either case it will be very important that the internal person/department or external third party has the necessary skills and competence to perform this function and has undertaken appropriate training.

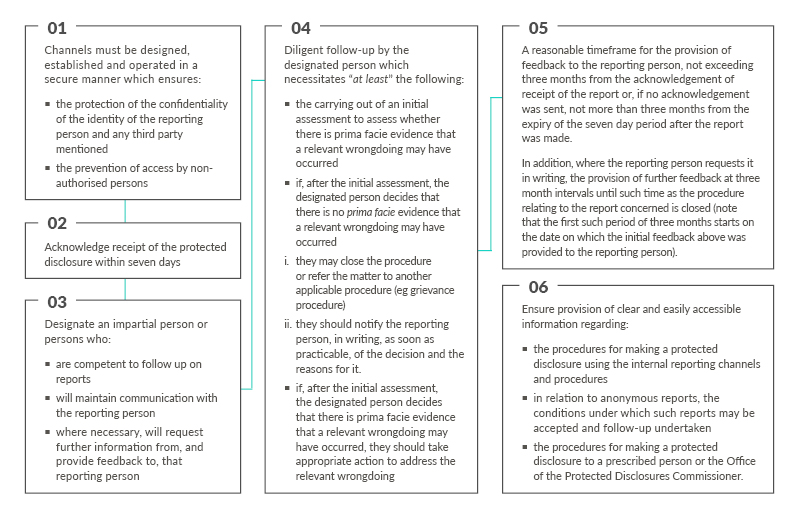

This step plan provides an outline of what needs to be put in place by way of internal reporting channels and procedures:

The internal reporting channels and procedures must enable a protected disclosure to be made in writing or orally, or both. Oral reporting should be possible by telephone or through a voice messaging system and, upon request by the whistleblower, by means of a physical meeting within a reasonable timeframe.

A key issue in relation to these channels and procedures is whether an employer can rely on a centralised group reporting channel, such as one operated by a hotline service provider, to comply with the Act’s requirements.

The European Commission Expert Group on the EU Whistleblowing Directive has indicated that the basic rule is that each legal entity captured by the requirement of the Directive is required to have its own reporting channels and procedures but that centralised reporting channels can also be used. In other words, centralised reporting channels cannot be the exclusive reporting channel.

In practice, we are seeing many employers retain their centralised group reporting channel, while also introducing a local reporting channel for each relevant legal entity. Indeed, it is quite common for employers to encourage employees to use the centralised group reporting channel and, in turn, presenting it as the primary channel, with the local reporting channel being presented as an optional alternative channel.

Of note to employers in scope from 17 December 2023 is a provision in the Act which provides that where an employer has less than 250 employees, it can pool resources with another group entity in relation to the triaging and investigation of whistleblowing concerns. However, where a worker utilises a centralised group reporting channel or where resources are being shared/pooled, the requirements of the Act still need to be adhered to where the reporting person is a ‘worker’ of an Irish employer. At its most basic level, this means the whistleblowing report should be acknowledged within 7 days by a designated person within the Irish employer and the feedback and any follow up actions should also be relayed via this same designated person.

Recommended Actions

Employers with 50 or more employees should take steps now ensure they are aware of their obligations under the Act and to ensure they are in a position to be compliant in just less than one month’s time. This will, at a minimum, involve designating appropriate staff as responsible for receiving any protected disclosures that are made and ensuring those disclosures can be made in a secure and confidential manner. Furthermore, given the statutory requirement to provide workers with clear and easily accessible information on the procedures for making disclosures using internal reporting channels and procedures, now is the time to ensure appropriate whistleblowing policies and procedures are put in place and to train managerial staff on the new regime.

Keep an eye out for the second publication in this three-part series in which we will cover the top queries we have received from clients during the first year of the whistleblowing regime.

For further information in relation to this topic, please contact Triona Sugrue, Knowledge Consultant, Ciarán Lyng, Associate, or any member of the ALG Employment team.

Date published: 22 November 2023.