Capital Markets – Equity

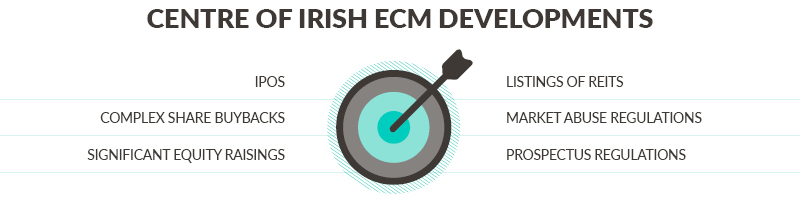

The Equity Capital Markets practice at A&L Goodbody is internationally renowned for advising on complex capital markets issues involving Ireland, the UK, the US, Europe and Asia. Our ECM group covers all the leading stock exchanges including the Irish and London Stock Exchanges, the NYSE and NASDAQ.

We have acted on most of the IPOs and listings of Irish companies over the last decade. Our team advises across the full range of equity capital markets transactions including on rights issues, open offers, placings, convertible and exchangeable issues, debt for equity swaps, continuing obligations under stock exchange rules, market abuse and securities law and Irish Takeover Rules.

We have also devised or adopted a number of highly successful and innovative capital markets structures for our clients seeking to effect capital markets reorganisations, including moving their primary listings, delisting, and share buybacks (including ADRs and shares listed on DTC), and court approved share capital reductions.

Experience

-

Malin Corporation plc

on a tender off to buyback shares.

-

Iterum Therapeutics plc

on its rights offering.

-

Corre Energy B.V.

on its equity fundraising of €2.7m by way of a subscription and private placing

-

Dalata Hotel Group

on its dual listing on ESM and AIM and its subsequent equity fundraisings and equity placings.

-

Glenveagh Properties

on its dual listing on the Irish and London Stock Exchanges, and related €550m equity raise and subsequent €213m equity raise by way of placing and open offer.

-

Cairn Homes

on its €400m IPO and admission to trading on main securities market of the London Stock Exchange.